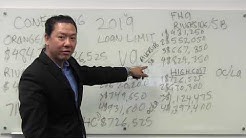

View 2019 Conventional / Conforming Loan Limits by County – This website provides 2019 conforming loan limits by county, as well as VA and FHA limits. In 2019, the baseline loan limit for most counties across the U.S. will be $484,350, an increase over 2018. More expensive markets, such as New York City and San Francisco, have conforming loan limits as high as $726,525.

Super Conforming Mortgages – Freddie Mac – Actual loan limits are established for each county (or equivalent) and the loan limits for specific high-cost areas may be lower.. Super conforming mortgages with original loan amounts of $1 million or less that have never been submitted to Loan Product Advisor are not eligible for delivery.

View 2019 Conventional / Conforming Loan Limits by County – This website provides 2019 conforming loan limits by county, as well as VA and FHA limits. In 2019, the baseline loan limit for most counties across the U.S. will.

Accounting for racial differences in housing credit markets – loan types, and markets (Avery, Beeson, and Sniderman, 1996; Holloway and Wyly, 2002). More formal analyses of lender underwriting behavior, such as Munnell, Tootell, Browne, and McEneaney (1996),

Jumbo Loan Vs High Balance Loan VA Loan prequalification: basic steps and What to Expect – VA Loan prequalification is your first step toward homeownership. Learn about the goals of prequalification and what to expect during the process.Fannie Mae Minimum Loan Amount PDF Fannie Mae HomeReady – Product Description – Aggregate $2,000,000 in total Gateway mortgage group loan amounts. Minimum of 2 years’landlordexperience documented on validated UnitedStates Federal taxreturn(s). For fannie mae product – Refer to Fannie Mae Selling Guide, B2-2-03 For Freddie Mac Product – Refer to Freddie Mac Selling Guide, Chapter 22.22.1.

Conforming Loan Limits 2019 Help First-Time. – The conforming loan limit was always a. This limit is set to 125 percent of the median home price of a county, Championed by martin luther king Jr. as a.

Agent: Lowering Conforming Loan Limits Will Cause Problems for Buyers and Sellers – In King County, loan limits have decreased from $567,500 to $506,000. With the Feds failing to approve maintaining the conforming limits, homes listed above this range will have problems finding.

Laurel Abbott: Good News for Santa Barbara Real Estate Market – For the past couple of years, the Federal Housing Finance Agency had been considering lowering the limits for Fannie Mae and Freddie Mac conforming loans. Lowering the loan limits would. and the.

Laurel Abbott: Good News for Santa Barbara Real Estate Market – For the past couple of years, the Federal Housing Finance Agency had been considering lowering the limits for Fannie Mae and Freddie Mac conforming loans. Lowering the loan limits would. and the.

Loan Limits for King County, Washington | FHALoans.guide – Local Loan Limits – King County, WA Loan Limit Summary. Limits for FHA Loans in King County, Washington range from $726,525 for 1 living-unit homes to $1,397,400 for 4 living-units. Conventional Loan Limits in King County are $726,525 for 1 living-unit homes to $1,397,400 for 4 living-units. The 2019 Home Equity Conversion Mortgage (HECM) limits in King County is $726,525.

Alec Bruice: 2017 Commercial Real Estate Forecast Is Strong – You are an important ally in our mission to deliver clear, objective, high-quality professional news reporting for Santa Barbara, Goleta and the rest of Santa Barbara County. Join the hawks club today.

2019 Conforming Loan Limits for all the Counties in. – Conforming and High Balance loan limits for most Washington state (WA) counties went up for 2019. Base conforming loan limit went up to $484,350 and the High Balance loan limit went up to $726,525. See below the list of all counties in Washington with 2019 loan limits for 1, 2, 3, and 4 Unit properties.

New conforming loan limits INCREASED for King County – The FHFA just increased the conforming loan limits for King County. What does this mean for local real estate?